SGFinDex

Singapore Financial Data Exchange (SGFinDex) is the world’s first public digital infrastructure to use a national digital identity and centrally managed online consent system, to allow individuals secure access to their financial information held across different government agencies and financial institutions, providing a consolidated view of their financial information across their accounts.

This is a joint initiative by the Monetary Authority of Singapore (MAS), the Smart Nation and Digital Government Group (SNDGG) and financial institutions.

A secure and convenient way to manage your personal financial position

SGFinDex enables convenient linkages from participating financial institutions – including banks, insurers, and The Central Depository (CDP) – to provide a consolidated view of your financial information at a glance for holistic financial planning.

Data is only retrieved after users have been authenticated by Singpass and given consent to the participating entities that they want to share data with. The consent period is for one year.

Users’ personal financial data is encrypted when it is retrieved through SGFinDex. SGFinDex cannot read and does not store the financial data. Only the financial planning application/website that has been authorised by the user to receive the data will be able to decrypt it. Data is kept confidential and protected during the data transmission process.

Users retain full control of their data and can withdraw consent anytime. Upon withdrawal or expiration of consent, the financial data will no longer be retrievable through SGFinDex from the participating organisations’ financial planning applications/websites.

Data that has been retrieved before may still be shown in the participating organisation’s application/website. Users who wish to have their data removed may contact the relevant financial institution directly.

How SGFinDex works

To view their consolidated personal balance sheet, users may:

- Log in to any of the participating organisations’ applications/websites or MyMoneySense, and navigate to SGFinDex.

- Authenticate themselves with Singpass to prove their identity – they will be directed to the main page for SGFinDex.

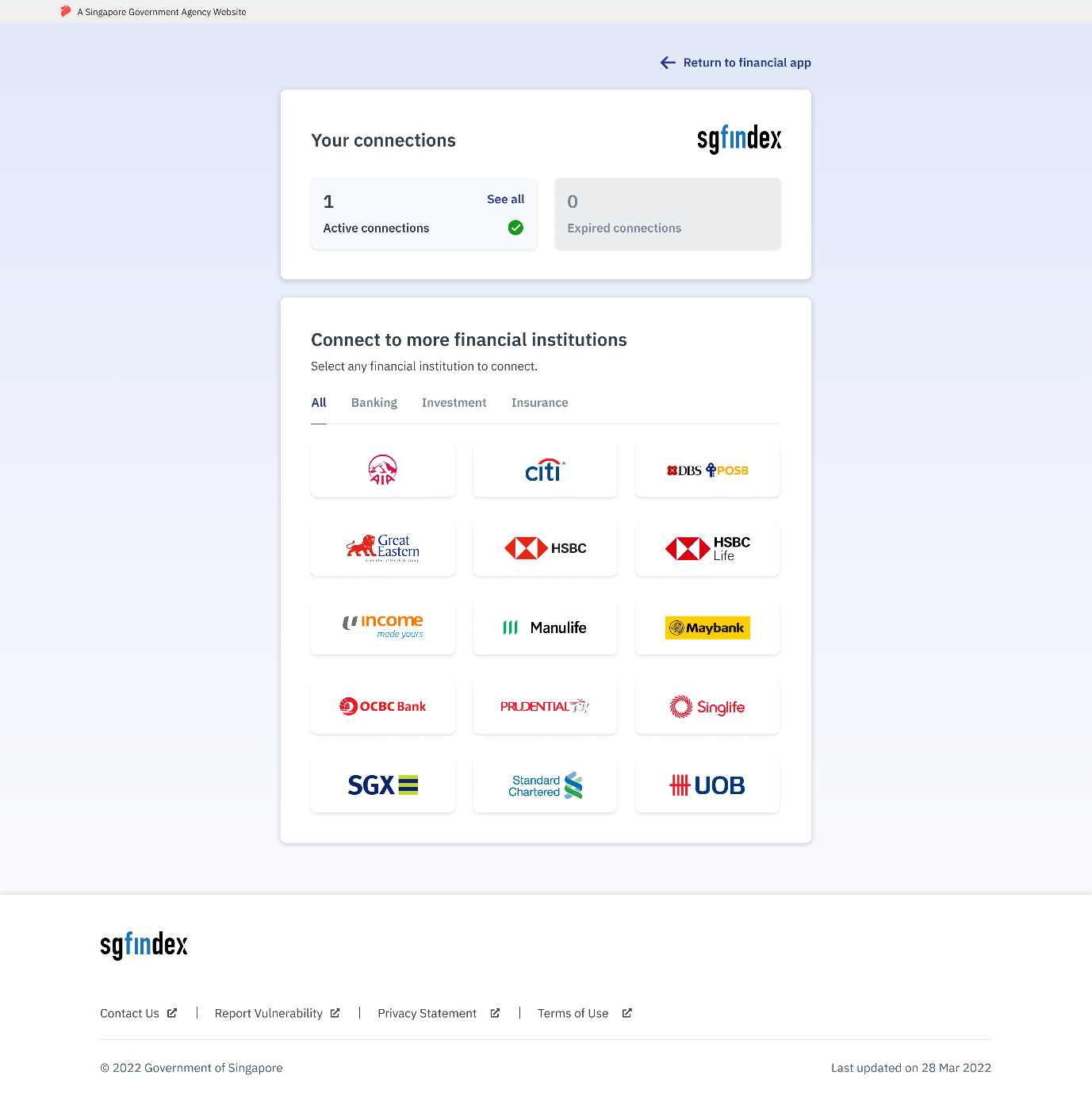

- Select the financial institution to connect to, and provide authorisation at the respective portal(s). Financial information from government agencies (CPF, HDB and IRAS) are already connected as part of Singpass.

- Synchronise the data explicitly. To protect users’ privacy, financial data is not updated automatically. Users may do this monthly to view their latest balance sheet.

Participating organisations

- AIA, Citibank, DBS, POSB, Great Eastern, HSBC, HSBC Life, NTUC Income, Manulife, Maybank, MyMoneySense, OCBC, Prudential, Singlife, Singapore Exchange, Standard Chartered, UOB

We are working with partner organisations to expand the financial products which can be included in users’ personal balance sheet.

Organisations interested to become a participant of SGFinDex may contact us at support@sgdex.gov.sg.

For more information, please refer to the FAQs.